A rendering of Lakeside Village looking north showing the restaurant plaza, residential and office towers, hotel, and cultural arts center.

TIRZ offers town a way to expedite construction and enhance value of project

“A walkable feast,” insisted Peter B. Stewart, president of Sunset Legacy Management (the partnership that controls the Lakeside Village site), as he pointed out lake views from the southern end and how synergies drive Lakeside Village.

“At every turn,” he added, “people will find beautiful landscapes, streets, views, and architecture. Our team is designing a built environment that celebrates and frames the natural beauty here.”

Jimmy Archie, managing parter of Realty Capital answers questions from residents near restaurant plaza at a Lakeside Village open house in the summer of 2017.

The four-acre parcel where Stewart stood sits 50 ft. above Lake Grapevine and offers panoramic views that encompass thousands of acres from the southeast to the northwest. A plaza is planned here with four to six restaurants positioned around the perimeter to serve up a selection of cuisines and vantage points over the lake.

Fly-over Lakeside DFW and Lakeside Village

Virtual drive-through Lakeside Village

The trails of Lakeside Village

Beneath the plaza — out of sight — three parking levels will provide nearly 600 public parking spaces.

“The restaurants require parking,” Stewart noted, “but no one wants to look at parked cars. Besides, parking lots take up so much space.”

“The underground parking also plays a crucial role in our commitment to making every angle of this project inviting. It’s a place designed to be enjoyed on foot. You’ll want to get out of your car as fast you can.”

“There just aren’t many properties like this one in North Texas,” added Jimmy Archie, managing partner of Realty Capital, master developer of Lakeside Village.

“It is a pretty compact site so we’re trying to maximize the impact of every square foot. Whether you’re dining at a restaurant or just walking around, you’ll find plenty of spots, both natural and built, from which to enjoy views of the lake.”

In addition to the restaurants, plans have carved out room for a cultural arts center (including a performance component) adjacent to the hotel site. Conference space also may be included in this facility.

“Uses will feed off of one another,” Archie said. “The trails will connect with the street level and vice versa, the wedding venue will bring business to the hotel and vice versa.

“The cultural arts center could offer conference space for hotel guests and the hotel might offer space to display art. The restaurants will attract residents and hotel guests, and some of those residents and hotel guests will attend performances at the cultural arts center.”

“It’s the connections between uses that fuel mixed-use projects like this,” added Archie. “More synergy between uses translates into more traffic for the businesses and more enjoyment for our visitors.”

FINANCING SYNERGY

Connections also frequently play a role in financing projects of this size, especially ones on undeveloped (and under-utilized) land.

Upon completion, Lakeside Village’s 40 acres are forecast to be valued at approximately $1.5 billion (see table below). For a comparison, Flower Mound’s 27,776 acres are currently valued at approximately $10.4 billion.

Even if the project fell short of these forecasts, Lakeside Village appears destined to become Flower Mound’s cash cow of the future.

To expedite development and to enhance Lakeside Village’s long-term tax valuation, town officials are exploring a commonly used tool: a tax increment finance (TIF) district or a tax incremental refinance zone (TIRZ, used by Flower Mound).

Flower Mound employed a TIRZ in 2006 to help with infrastructure work along FM 2499 between FM 1171 and 407. This TIRZ also helped pay for the construction of the new town hall and the library.

These tools define an area where an investment can significantly increase taxable value. To ensure repayment, tax revenue on the incremental value (the difference between the existing value and future value of a property) flow to a fund that pays down the municipal bonds issued to finance the infrastructure investment.

“You use TIFs to either redevelop an area that is lacking in infrastructure,” explained Jay Chapa, economic development director for Fort Worth, in a Fort Worth Star-Telegram story in December 2014 (see “The TIF of the iceberg”), “has old infrastructure or has underused property and you want to bring it to life.

“So you have an overlay that will assist the private sector when they come in there.”

The tax overlay provides a degree of certainty to the capital markets, making large infrastructure investments possible.

“Building the infrastructure at Lakeside Village in one phase will enhance the values of each component of the project right from the start,” said Archie.

“For example, villa homes will sell faster and at higher prices, if restaurants are opening on the south end. More restauranteurs will open those establishments if a hotel is going up next door. And, of course, a cultural arts center would give the hotel operator a big boost.”

Adding value up front also speeds repayment of the bonds and moves forward the date when the project’s tax revenue can flow into the town’s general fund.

NEIGHBORHOOD CASE STUDIES

Two seminal suburban projects near the north end of DFW Airport were made possible by these financing tools. Taxing districts for Grapevine Mills Mall and Southlake Town Square (see table below) were created just one year apart in the late nineties.

[“table id=1 /”]

** TIF was created to help with the development of Southlake Town Square, a trendy outdoor shopping and entertainment area that has become one of the most popular retail destinations in North Texas. The TIF has paid for public infrastructure and public parks, a joint city/county facility that opened in early 2000 and parking. Current value is from 2017.

*** TIRZ has not yet been approved. Current value is a projection for the year 2032 (for more detail on these figures, see “Build-out property valuations” in table above.)

“[Grapevine Mills Mall] is not only developing additional sales tax revenue for the city, but it also spurred development around the mall,” John McGrane, director of administrative services for Grapevine, told The Fort Worth Star-Telegram in December 2014.

“The idea [at Grapevine Mills Mall],” McGrane explained, “is that the initial upfront development would spur economic growth and development, which then not only provides those additional revenue streams for the city and county but also creates jobs in the community.”

The Star-Telegram story noted, “The Grapevine Mills Mall TIF, started in 1996, is credited with creating an environment for growth in an area that now includes the Gaylord Texan Resort, Bass Pro Shops and Great Wolf Lodge.”

Other examples of these special taxing districts in the DFW area include Uptown (Dallas), Sundance Square Plaza (Fort Worth), Fort Worth’s near south side (including the trendy Magnolia Avenue), Texas Motor Speedway, and Arlington’s thriving Entertainment District (which includes Globe Life Park and AT&T Stadium).

Follow

Follow

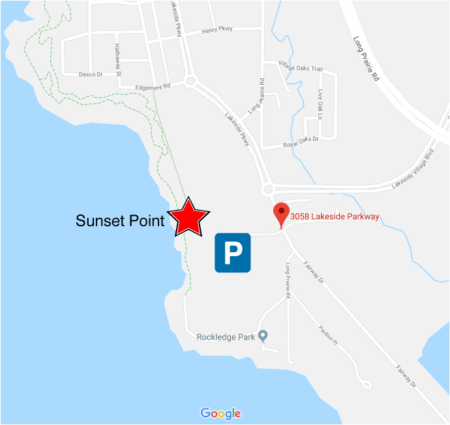

Click map for directions to

Click map for directions to

Larry Shafer says

If it’s like the River walk, they will spend 5years building hundreds of houses & thousands of apartments first before the River walk is started & still not finished. As it stands people from the houses & apartments can take their dogs down to the River Walk. Tourist will surely like that — NOT

Shannon Kuithe says

I so agree with all of these statements. A few weeks ago I got into an argument on Flower Mound Cares FB page about this very subject. I probably didn’t word as well as this article did but I was so frustrated I just stopped the debate.

Glad you are explaining this and also please explain how people who rent will not lower our house value.